- >Best Crypto Exchanges

- >Kraken Review

Kraken Exchange Review: All About Trading, Fees, and Safety

Kraken at a Glance

One of the world’s most trusted and secure crypto exchanges with low fees and advanced trading tools.

Pros

One of the original cryptocurrency exchanges

Strong industry reputation for security

Wide range of funding options

Regulated and licensed in many markets

Supports 350+ assets

Cons

Not available in some countries and certain U.S. states

Account verification can be slow

Experienced a treasury security incident in 2024 (no customer funds lost)

Supported cryptocurrencies

500+ assets supported

FIAT Currencies Accepted

USD, EUR, GBP, CAD, CHF, JPY

Trading Volume and Liquidity

~$1.5 Billion (24h Spot Volume)

Number of Users

15 million verified users

Customer Support

24/7 live chat, email support, dedicated OTC Desk, and Kraken Institutional for corporate clients

Fees

Maker: 0.16% / Taker: 0.26% (lower fees for Pro Users)

Highlights

The platform is committed to regulatory compliance and holds an E-Money Institution (EMI) and a Crypto Asset Service Provider (CASP) license. They are FCA registered in the UK, FinCEN registered in the US, and are the first crypto exchange to receive a US bank charter.

Customer protection is prioritized through geographically distributed cold storage for customer funds and publicly verifiable Proof of Reserves audits. Security features include mandatory two-factor authentication (2FA), Global Setting Lock (GSL), and withdrawal whitelisting. The exchange has also never been hacked.

Kraken Pro users enjoy a comprehensive suite of crypto trading features, including futures, margins, and institutional OTC services. Users also benefit from a low 0.00% maker fee at the highest tier.

Fees and Costs

Trading on the base platform comes with a straightforward fee structure for instant purchases. Fees will vary depending on the asset type and market spread. Users who pay for a Kraken+ subscription pay zero trading fees on the first $10,000 in money trade volume a month.

Pro users are subject to maker/taker fees. These fees are discounted based on their 30-day rolling trading volume.

Deposit and withdrawal fees

During our Kraken review, we found that fiat deposits are free, while withdrawals are subject to a small, fixed fee. It’s important to note that some fiat funding methods may incur third-party bank fees. Crypto withdrawal fees are fixed based on the asset you are withdrawing to cover the blockchain network cost.

Margin/futures fees

Margin positions on the platform incur a small opening fee, and a rollover fee is charged every four hours. Futures trading uses a separate maker/taker fee schedule that includes volume rebates for institutional clients and high-volume traders.

Hidden costs

Market spreads are not necessarily “hidden,” but they are applied to all instant buy/sell/convert transactions on the main platform, in addition to a flat 1% trading fee.

This does not mean the user pays more, but it means they pay both the fee and the spread, which is integrated into the final transaction cost. Spread fees can fluctuate, and converting small crypto balances incurs a fixed 3% charge.

It’s also important to remember that executing transactions with credit or debit cards may incur fees with your financial service provider.

Security & Regulation

Kraken is regarded as a pioneer of security and is regarded as one of the safest cryptocurrency exchanges. Over 15 million verified users trust the exchange enough to trade more than a billion dollars a day on the platform.

Storage & custody

The exchange holds the majority of clients’ funds offline or in “cold storage.”

A unique characteristic of the platform is that cold storage is geographically distributed, indicating that storage devices are spread out across different regions. This is designed to mitigate several risks, including natural disasters, physical threats, and geopolitical situations.

The platform subjects itself to rigorous, third-party penetration testing and auditing.

Account security

All user accounts are secured with mandatory two-factor authentication. Users can also use advanced security protocols provided by the platform, like Global Settings Lock (GSL) and withdrawal whitelisting. GSL delays changes to account settings, while wallet whitelisting allows the users to pre-approve addresses for cryptocurrency withdrawals.

Sensitive information and data are protected using AES-256 encryption. It’s regarded as one of the most secure data encryption practices and is trusted by governments and financial institutions to protect data.

Regulatory licenses

In the United States, Kraken is registered as a money service business with FinCEN for regulatory compliance. It also holds a Special Purpose Depository Institution (SPDI) charter from Wyoming, which functions as a U.S. banking license specifically for handling digital assets.

The exchange enjoys authorization from the Central Bank of Ireland under MiCA regulations. This means it can operate across several member states with supervision from Germany’s BaFIN. The company is also registered with the Financial Conduct Authority (FCA) in the UK and holds licenses in Canada, Japan, and Australia.

Past incidents and mitigation

The platform has never been hacked or suffered any unrecoverable losses.

Features & Tools

Millions of people trade on the platform due to its institutional-grade security, wide array of crypto tools, and earning features.

Trading features

The platform has two main interfaces, namely the ‘Buy Crypto’ interface and the professional-grade Kraken Pro platform.

The Pro version of the platform gives experienced users access to a highly customizable dashboard featuring detailed charting tools and over 15 advanced order types. This includes take-profit, stop-loss, and conditional close, and deep market liquidity.

The exchange also offers access to regulated futures and margin trading, supporting up to 5x leverage on dozens of assets.

This allows users to execute complex strategies and access global derivatives markets directly from the platform. Multiple major fiat currencies are supported on the platform, which ensures seamless conversions between traditional and digital assets.

Staking & earnings

Several assets are available for staking, including Solana, Polkadot, Cardano, and Ethereum. Users can stake directly on the platform and earn competitive returns that often reach up to 20% APY depending on the asset.

All staking rewards are automatically managed and paid out, making the platform’s offering one of the simplest ways for clients to grow their holdings passively.

NFT marketplace & crypto services

The exchange has significantly invested in providing Web3 functionality through its integrated NFT Marketplace. Its marketplace supports trading across multiple blockchains and charges zero gas fees for internal transfers and transactions.

Kraken Pro and mobile app

The Pro interface provides users with quicker transactions, deeper analytics, and granular control over their trades. It includes advanced data visualization tools, real-time trading data, and a straightforward, competitive maker-taker fee schedule.

The mobile app is available on both Android and iOS devices. The primary app mirrors the beginner interface, focusing on ease of purchasing and portfolio monitoring. However, a separate Kraken Pro mobile app is also available, which mirrors the advanced features and charting capabilities of the desktop Pro platform, enabling comprehensive, sophisticated trading while on the move.

Key differences between the base app and the Pro app:

Feature

Base App

Pro App

User Interface

Beginner-friendly, streamlined buying and selling

Customizable dashboard for experienced traders

Fees

Flat fee (approximately 0.40%)

Tiered Maker/Taker Fee Schedule

Order Types

Basic market and limit orders

Advanced, market, limit, stop-loss, take-profit, and more

Charting Tools

Basic price charts, limited indicators

Advanced charting with technical indicators, overlays, comparison charts, and drawing tools

Ideal Use Case

Beginners wanting a simplified trading experience and easy portfolio management

Professional traders needing advanced tools, analytics, and lower fees

Institutional & API tools

Institutional and high-volume traders have access to dedicated account management, deep liquidity pools, and the OTC trading desk.

Furthermore, Kraken offers exceptionally strong API tools that allow algorithmic traders and financial institutions to integrate directly with their trading engine for automated, high-frequency strategies with minimal latency.

Supported Assets & Markets

The exchange works with many cryptocurrencies and fiat currencies, so users can trade both well-known coins and new projects in several different ways.

Cryptocurrencies & tokens

Kraken supports the purchase of over 500 cryptocurrencies and digital assets. This includes all the major coins like Bitcoin, Ethereum, Cardano, and Solana. You’ll also find a diverse mix of emerging DeFi, Layer 1, and Web3 assets like Polkadot, Chainlink, Cosmos, and numerous stablecoins, catering to a wide range of investment and trading strategies.

Fiat pairs

The platform supports seven major fiat currencies and accepts multiple payment methods. These include the US dollar (USD), euro (EUR), British pound (GBP), Canadian dollar (CAD), Swiss franc (CHF), Australian dollar (AUD), and Japanese yen (JPY).

This means you can directly purchase assets like Bitcoin, Ethereum, and Cardano using fiat or cash out your crypto holdings back to your preferred currency using various low-fee deposit options like ACH, SEPA, and domestic bank wires.

Geographic availability

The platform is available in nearly 200 countries and territories worldwide. They maintain licensing and regulatory compliance across major global jurisdictions, including Europe and Canada. The availability of certain trading features may vary due to local regulations and the client’s country or state of residence.

Usability & User Experience

The platform has two separate mobile applications to suit different user needs. The standard mobile app offers an intuitive experience for beginners, focusing on easy purchasing, selling, and portfolio management.

Its separate Pro mobile app is robust, mirroring the advanced features and charting capabilities of the desktop Pro platform which allows for comprehensive trading on the move with smooth performance.

Learning curve

While the main interface promotes user-friendliness and simplicity for quick transactions, the expansive features of the Pro platform and derivatives markets introduce a more significant learning curve.

Newcomers should definitely check out the Kraken Learn Center, which provides a wealth of educational materials covering crypto basics, security, trading tutorials, and advanced concepts.

Customer support

The exchange offers 24/7 global customer support via live chat and email with a team of dedicated crypto and finance specialists who provide personalized solutions. The exchange maintains a high level of support, often rating highly in the industry.

Additionally, their comprehensive Support Center offers an extensive library of articles and self-service tools, including account lock and recovery options, to assist users immediately.

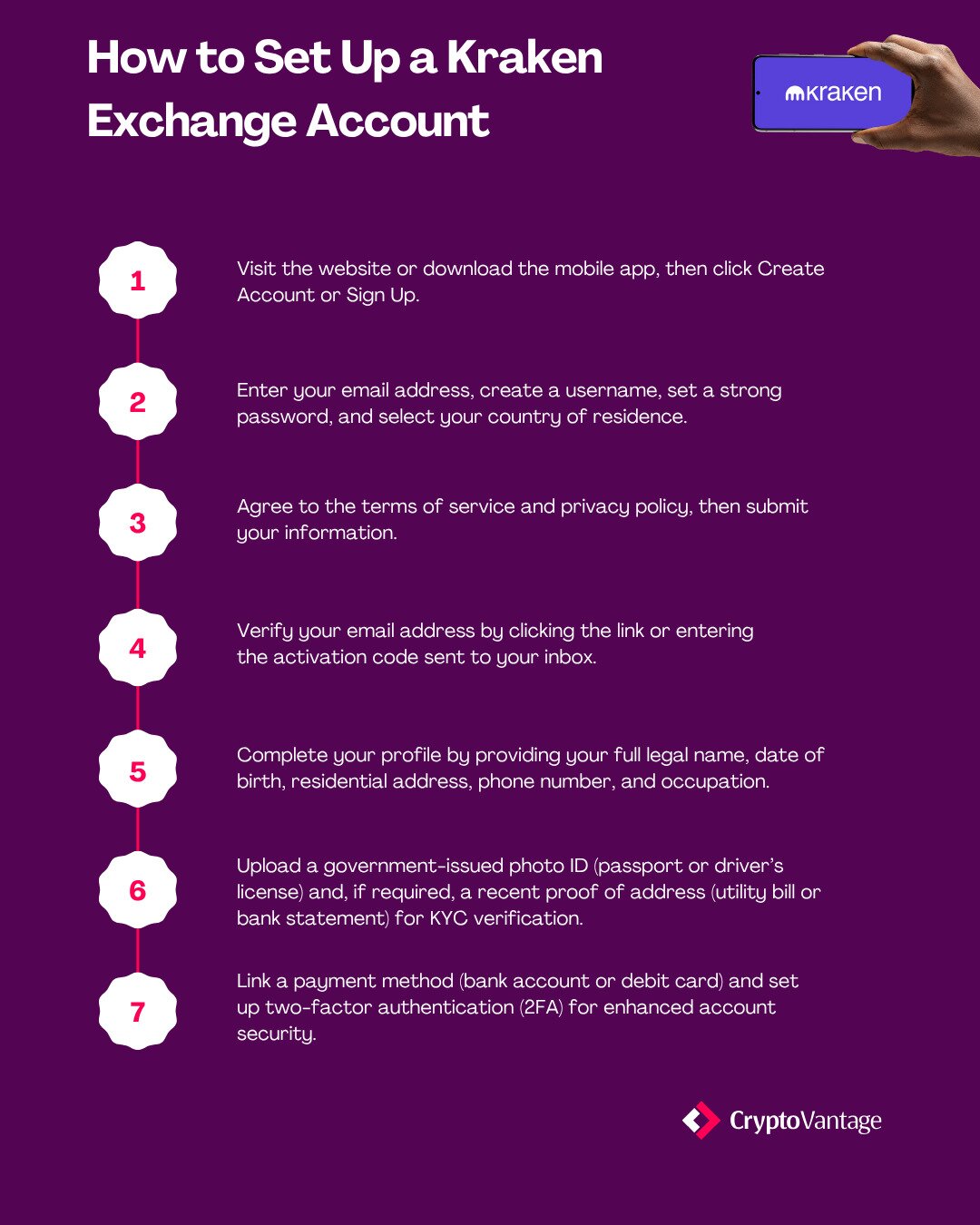

How to Set Up a Kraken Exchange Account

If you want to try out the platform for yourself, here’s what you need to do:

Once your identity is verified (which can take from a few minutes to several days, depending on your region and verification level), you can begin trading.

History & Background

Jesse Powell founded the exchange in 2011 after noticing security issues during the early days of the crypto industry. His goal was to establish a secure and reliable Bitcoin exchange, and the platform formally launched trading operations in 2013, quickly establishing itself as a place for buying, selling, and storing digital assets.

Milestones & growth

Since its launch, Kraken has achieved considerable growth, distinguishing itself with key industry firsts. In 2015, the exchange launched both a margin trading facility and an early dark pool for large, discreet orders.

The exchange expanded its product suite by acquiring a derivatives trading firm in 2019, entering the futures trading market. In 2020, they made history by becoming the first crypto company to receive a Special Purpose Depository Institution (SPDI) banking charter in Wyoming, establishing a fully regulated bank.

Reputation & public events

The platform has a strong reputation for prioritizing security, transparency, and compliance. It consistently maintains advanced security features, including proof-of-reserves audits and extensive cold storage for customer funds.

This prioritization of securing client assets has led to the platform earning high marks for reliability. Its commitment to regulation and its long-standing track record make it one of the industry’s most trusted and battle-tested exchanges.

Kraken Alternatives

While our Kraken exchange review reinforced their strong reputation for robust security, ease of use, and a wide range of tradable assets, it may not be for you. We’ve compared them with some of the best cryptocurrency exchanges; check out our review to see which platform matches your trading needs.

Exchange

Ideal For

Fees and Pricing

Security Features

Regulation and Security

Kraken

Security-First Traders

0.16%/0.26% (Low Tier)

Proof-of-Reserves, Cold Storage

U.S. & Global Licenses

Beginners & Fiat Access

0.40%/0.60% (Advanced)

Cold Storage, Insured

SEC-regulated, publicly traded

Compliance-Focused

0.20%/0.40% (Active Trader)

Hardware Security Modules

NYDFS-regulated

Final Thoughts & Verdict

Kraken stands out as a leading recommendation for users who demand institutional-grade security combined with advanced trading sophistication. While complete beginners might find the standard interface sufficient, the platform truly excels for those ready to move beyond simple buys and sells.

If you are looking for a reliable platform that delivers uncompromising security and a deep product suite, including regulated margin and futures trading, Kraken is the perfect choice. It also offers competitive returns via staking, a zero-gas-fee NFT marketplace, and reliable, personalized 24/7 customer support.

FAQs

Yes, it is considered one of the safest cryptocurrency exchanges. The platform uses advanced security measures like two-factor authentication, cold storage for most assets, and regular security audits. The exchange is also regulated in multiple jurisdictions and has a strong reputation for transparency and reliability. As with any exchange, you should enable all available security features and use self-custody for large balances to maximize safety.

Yes, it is a well-established and trusted platform. It has been up-and-running since 2011, and ticks all the boxes when it comes to security, regulatory compliance, and transparency. The platform is registered as a Money Services Business (MSB) with the US Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN). This also ensures that it complies with the necessary anti-money laundering (AML) and know-your-customer (KYC) requirements.

As we have discussed at length, Kraken is a great platform to buy, sell, trade, and even invest your digital assets. However, it is always best to rely on a self-custody hardware wallet for long-term secure storage. Take a look at our top list of the safest crypto wallets for more guidance on secure storage.

These exchanges are actually quite evenly matched. Both of them offer excellent security features, a wide variety of assets, helpful tools, and special features, not to mention they both have dedicated platforms designed for more advanced users. In the end, the best choice will really come down to your personal trading goals and preferences. If you do decide to switch, don’t forget to follow the process outlined in our How to Transfer From Coinbase to Kraken guide to ensure none of your tokens go missing along the way.