- >Best Crypto Exchanges

- >Paybis Review

Paybis Review: Should You Trust the Crypto Trading Platform?

Paybis at a Glance

A crypto brokerage focused on global fiat-to-crypto access.

Pros

Easy sign-up and purchase process

Variety of payment options

24/7 customer support

Available in 180+ countries

Cons

Limited selection of cryptocurrencies

Higher fees compared to some exchanges

No advanced trading features

Supported Cryptocurrencies

80+ cryptocurrencies supported

Fiat Currencies Accepted

USD, EUR, GBP, AUD, JPY, and more

Trading Volume and Liquidity

$2.6 billion

Number of users

Over 4 million users worldwide

Customer support

Live chat, email support, help center

Fees

Transaction and processing fees

Highlights

Paybis has established itself as one of the most globally accessible and compliant on-ramps for cryptocurrency purchases. This reputation is built on strict regulatory compliance, prioritizing customer safety, and providing the services users expect out of a crypto trading platform.

The platform’s greatest strength is its unmatched versatility and simplicity for purchasing crypto. As a straightforward service, it supports over 80 cryptocurrencies and offers more than 16 payment methods, making it one of the easiest platforms to use globally. Users can buy digital assets instantly using credit cards, bank transfers, PayPal, Skrill, Neteller, Apple Pay, and Google Pay.

The exchange serves as a simple bridge between traditional finance and cryptocurrency, specifically catering to users who prioritize simplicity over complex trading features.

Fees & Costs

Paybis has a unique fee structure where users are charged a transaction fee and a network fee to complete a trade.

Spot trading fees

The exchange charges clients an all-inclusive service fee and a network (gas) fee. The service fee serves as their commission for facilitating the transaction, with a minimum of $2 required to cover operational expenses.

Fees vary depending on the payment method and range from 2.4% to 4.5% of the total trade value when using credit cards. Bank transfer costs are slightly less than credit card payments. Service fees can fluctuate depending on the currency used for the transaction.

Deposit & withdrawal fees

While the exchange does not have explicit deposit and withdrawal fees, users pay network and gas fees. This means that the cost of completing a transaction on a particular network may require users to use the network’s native coin.

Hidden costs & spreads

The platform is committed to full fee transparency, including clearly informing clients about any charges outside the exchange’s control, such as hidden or less obvious costs. These costs include credit card fees, foreign exchange fees, and bank transfer fees.

Security & Regulation

The platform has distinguished itself as one of the safest cryptocurrency exchanges and protects clients’ funds with comprehensive security measures.

Storage & custody

The majority of customer crypto held by the platform is secured offline in cold storage, and Multi-Party Computation (MPC) technology is used to enhance security. MPC splits private keys into fragments, distributing them across multiple secure servers, which eliminates the possibility of a “single point of failure” that hot wallets face.

All communications and transactions are SSL encrypted using industry-standard protocols to add an extra layer of protection.

Account security

Client accounts are protected with mandatory two-factor authentication (2FA) using authentication apps or SMS verification. Six-digit SMS codes are required for all crypto withdrawals, and users can monitor and control account access from different devices.

Audits & compliance

Paybis follows strict anti-money laundering (AML) policies while employing comprehensive know-your-customer (KYC) identity verification to prevent fraud. Their status as PCI DSS Level 1 mandates yearly external audits to protect cardholder data security. This is complemented by regular independent third-party audits.

Regulatory licenses

The platform maintains regulatory compliance with the Financial Crimes Enforcement Network (FinCEN) in the United States and holds licenses to operate in 48 US states. They also have regulatory approval from the Financial Transaction and Reports Analysis Centre of Canada (FinTRAC), which registers them as a Money Services Business in the country.

They are registered as a virtual currency business with the Revenue Administration Chamber in Poland and operate under European Union Data Protection laws.

Past incidents & mitigation

Paybis has never suffered a security breach, loss of customer funds, or data due to a hack of its platform.

Features & Tools

Our Paybis review found the platform caters to users who value simplicity over complex trading features. While it lacks advanced trading features, users still benefit from key functionalities, speed, and overall simplicity.

Trading features

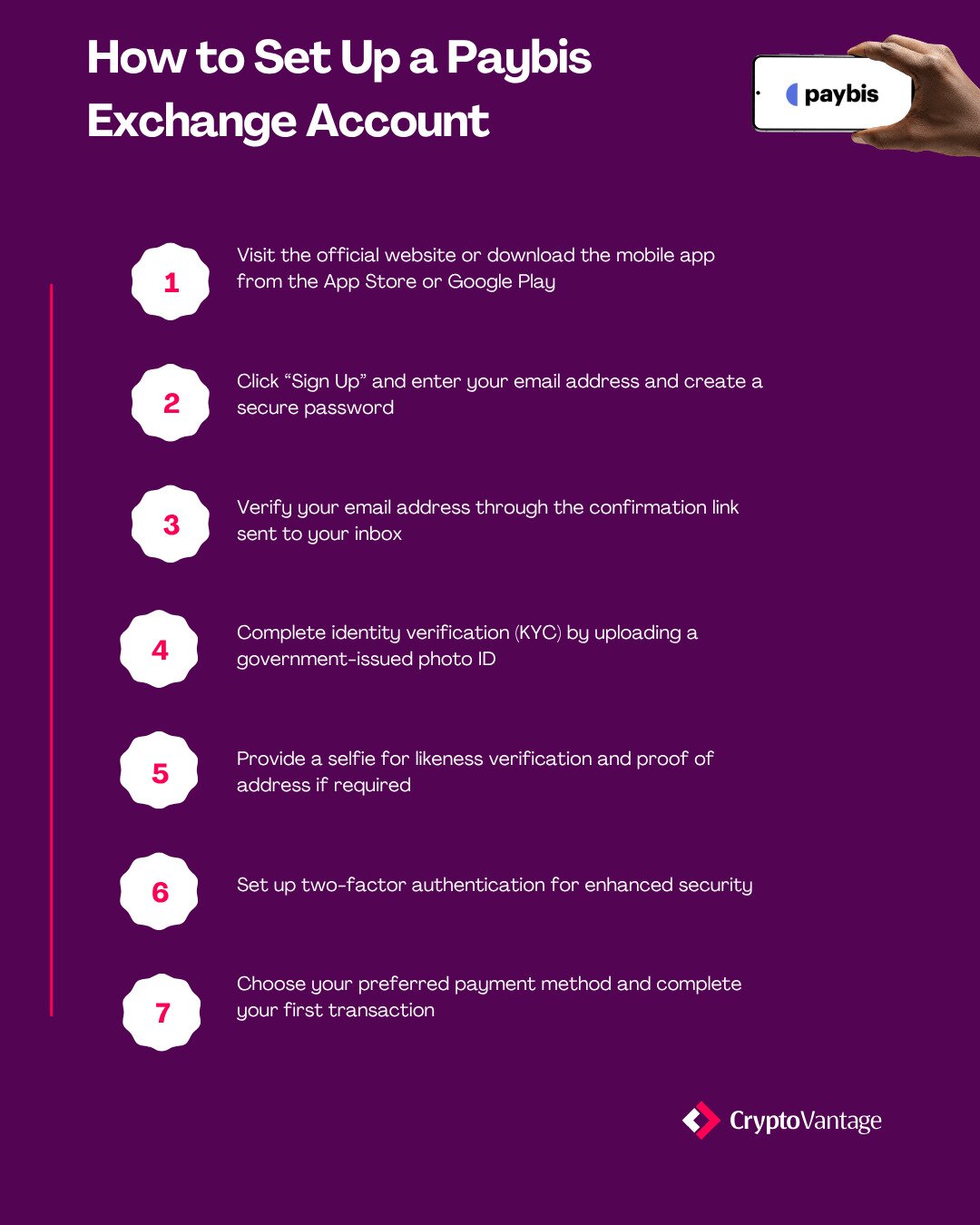

The exchange primarily operates as an on/off-ramp rather than a traditional exchange with an order book. Trading is simple, with users simply entering the amount of fiat currency they want to spend, and the platform displays the exact crypto amount they will receive (and vice versa.) This makes the platform ideal for beginners exploring crypto trading.

Crypto swaps can be executed on the platform, which allows users to exchange one supported cryptocurrency for another. This is great for managing smaller investment portfolios.

Crypto services

Platform users get access to a free built-in crypto wallet service. This service, launched in 2024, lets users securely store multiple cryptocurrencies, track prices in real time, and manage investment portfolios on the go.

Mobile application

The platform has a fully functional mobile application available for download on iOS and Android. Users can buy, sell, and swap crypto on the app in addition to tracking their investment portfolios and accessing 24/7 customer support.

Institutional & API tools

Several business-to-business (B2B) services are available from Paybis Business Solutions. Companies can use the platforms on-ramp/off-ramp services to integrate the exchanges’ fiat-to-crypto and crypto-to-fiat functionality onto their platforms.

Additionally, their send tool allows businesses to instantly make mass crypto payments, while their Corporate Wallets service provides secure wallet and management solutions to businesses.

Supported Assets & Markets

The Paybis crypto platform supports over 80 cryptocurrencies, focusing on established and liquid digital assets. They regularly add new coins based on market demand and regulatory compliance. Some examples include:

Cryptocurrencies & tokens

Paybis supports the trading of more than 80 cryptocurrencies and tokens on the platform. This includes established cryptocurrencies like Bitcoin and Ethereum; altcoins like Solana, Cardano, and Litecoin; and stablecoins like USD Coin and Tether.

Fiat pairs

The exchange is globally available, accepting over 65 fiat currencies on its platform, including USD, GBP, ZAR, and NZD.

Geographic availability

Paybis operates in more than 180 countries around the world. However, local regulations may limit the services available in specific regions.

Usability & User Experience

Paybis’s greatest strength is the speed and simplicity it offers new crypto traders. It is designed specifically to facilitate quick, hassle-free transactions.

Desktop & web interface

The web interface is clean, direct, and intuitive. The crypto calculator is prominent, so users can trade with minimal fuss that can be caused by advanced order books and charts. Fees are displayed upfront, so users know exactly what a trade will cost.

Mobile app experience

The mobile application maintains the user-friendliness of the main platform and ensures that buying, selling, and swapping can be done with ease. It includes all the core functionality the exchange offers, including the buy/sell calculator, real-time price trading, and management of the integrated wallet. The app is available in multiple languages.

Learning curve

Paybis has a low learning curve, which makes it ideal for new users and beginner crypto traders. The signup process can be completed quickly, and the minimal trading features mean beginners can get to grips with the platform easily.

Customer support

Customer support is available 24/7, with the primary methods including a live chat and email support. An extensive help center with numerous FAQs covers common issues users may face when using the platform.

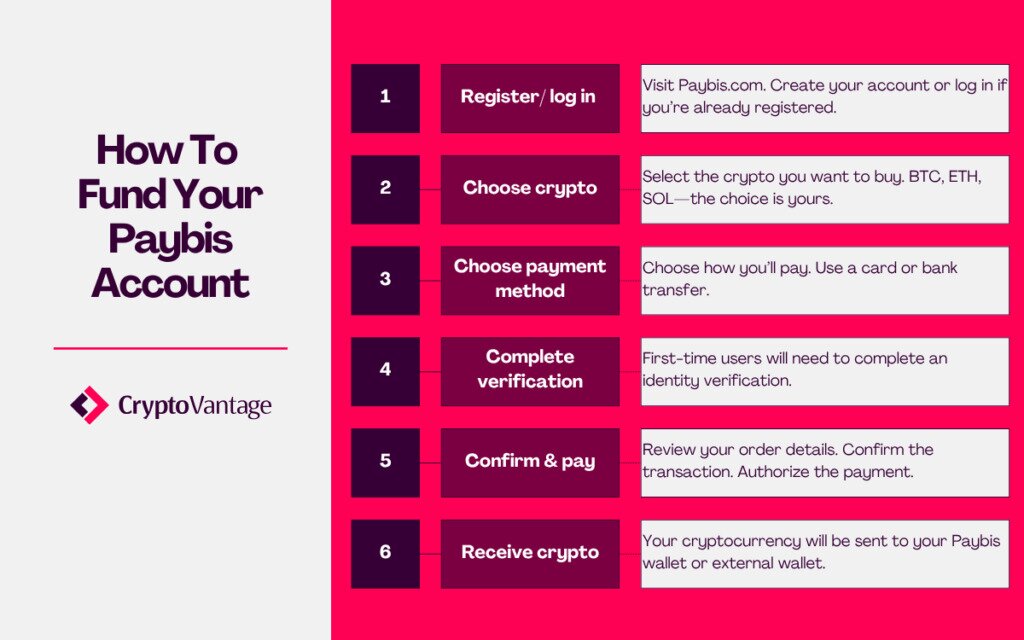

How to Set Up a Paybis Exchange Account

If you want to try out the platform for yourself, here’s what you need to do:

Most identity verification is processed instantly, though manual reviews can take up to 60 minutes in some cases. Once verified, you can immediately start buying cryptocurrencies.

History & Background

In 2014, Innokenty Isers, Konstantin Vasilenko, and Arturs Markevich founded the Paybis crypto exchange. The trio of friends came from a gaming and esports background. The trio recognized the growing potential of cryptocurrency services. The company registered its domain in 2014 and officially began operations in 2015.

The founders concentrated on building a robust technical framework, simplifying the registration process, and prioritizing security measures.

Milestones & growth

Paybis has impressively remained self-funded throughout its history without external investment. They have successfully scaled to serve more than 1.5 million users in over 280 countries around the world.

Since their founding, they have registered with key regulatory bodies around the world. They’ve also expanded their payment options to ensure they can serve clients effectively across the globe.

Their services expanded to providing B2B products that businesses can use to process crypto payments. All these factors contributed to the exchanges’ record trading volume of $2.6 billion in 2023.

Reputation & public events

Paybis has earned a reputation as being a globally compliant crypto gateway that allows users to interact with digital assets with ease and speed.

Paybis Alternatives

Paybis offers great trading functionality, a wide variety of crypto assets, and strong security protocols to protect clients’ funds. However, if you’re weighing your options, explore how the best crypto exchanges compare in terms of features, fees, and coin selection.

Exchange

Ideal For

Fees & Pricing

Security Features

Regulation & Security

Paybis

Beginner traders

Fixed fees

Advanced fraud protection

FinCEN registered

Final Thoughts & Verdict

If you want a simple, hassle-free way to buy and sell crypto with everyday payment methods, Paybis delivers exactly that. You can set up an account, verify your identity, and start purchasing coins in just minutes. This means you don’t need to dig through complex order books or master trading tools to get started.

If you’re looking to trade countless coins, hunt for the lowest fees, or use advanced crypto tools like margin or futures, you might be better off exploring other exchanges.

FAQs

Yes, they maintain strong safety measures, including FinCEN registration, cold storage for funds, mandatory 2FA, and comprehensive KYC procedures. Their 4.2-star Trustpilot rating from over 20,000 reviews further indicates high customer satisfaction.

Yes. They are registered with FinCEN and licensed to operate in 48 US states, excluding only New York and Louisiana.

Payment methods include credit/debit cards, bank transfers, PayPal, Skrill, Neteller, Apple Pay, Google Pay, and various regional payment systems, depending on your location.

The minimum purchase amount is $5 for most cryptocurrencies. Maximum limits vary by payment method and user verification level, with some methods supporting transactions up to $500,000 daily.

No, they don’t support margin trading, futures contracts, or advanced trading features. They focus exclusively on simple buy/sell transactions between fiat currencies and cryptocurrencies.