- >Best Crypto Exchanges

- >Prime XBT Review

PrimeXBT Exchange Review 2026: Best Features Revealed

Prime XBT Overview

A trading platform offering crypto, forex, and indices with leverage.

Pros & Cons

Pros

Multi-asset derivatives from one account

Low fees for derivatives trading

High leverage up to 100x-1000x

Covesting copy trading feature

No mandatory KYC for basic crypto trading

Cons

Unavailable in the US, Canada, Japan

Operates without Tier-1 regulatory licenses

Some users report fiat withdrawal delays

No public proof of reserves or audits

Complex interface can be unsuitable for beginners

Highlights

PrimeXBT is a multi-asset trading platform that provides access to spot trading, margin trading, perpetual futures contracts, forex pairs, commodities like gold and oil, and stock CFDs, all from a single account.

Fees are competitive, and active traders can even get volume-based discounts. They operate a Straight-Through Processing model (STP), routing client orders directly to liquidity providers for fast execution. The exchange is available in over 150 countries.

Fees & Costs

The platform applies specific fee rates across its trading products and includes external costs you must navigate.

Spot trading fees

For crypto futures trading, PrimeXBT charges 0.05% for both makers and takers. The platform advertises maker fees starting from as low as 0.01% for high-volume traders. Volume-based discounts are available based on your 30-day rolling trading volume.

Instant buy/sell fees

They instant crypto purchases via credit/debit card through their payment partner Baksta. Fees depend on the payment processor used. Card purchases may incur additional payment processing fees beyond the platform’s standard trading fees.

Deposit & withdrawal fees

Cryptocurrency deposits are free across the platform. Cryptocurrency withdrawals vary by asset. Fiat deposits are available via credit/debit cards, bank transfers, and e-wallets (Skrill, Neteller). They don’t charge internal deposit fees, though payment processors may add their own charges. The minimum fiat withdrawal fee is $0.50, with costs varying by payment processor and currency.

Margin/futures fees

PrimeXBT charges 0.05% for both maker and taker fees on crypto futures trading. All traders pay the same base rate, though high-volume traders can access discounts starting from 0.01%. For CFDs on forex, commodities, and indices traded through PXTrader and MetaTrader 5, the platform doesn’t charge direct commissions; instead, you’ll trade on competitive spreads.

Crypto perpetual futures charge funding rates every 24 hours to keep contract prices aligned with spot markets. Most cryptocurrency pairs have a 0.05% funding rate, while some altcoins charge 0.0833%.

If you’re holding a long position when the funding rate is positive, you’ll pay shorts. If the rate is negative, shorts pay longs. When you hold leveraged positions overnight, you’ll incur these financing fees based on your position size and the current market conditions.

Hidden costs & spreads

For CFD trading on forex, commodities, and indices, PrimeXBT doesn’t charge direct commissions but operates on spreads between bid and ask prices. These spreads vary by asset class and market conditions.

Major forex pairs typically have tighter spreads, while exotic pairs and smaller assets may have wider spreads. During high-volatility periods or major news events, spreads can widen significantly, increasing your trading costs.

Price slippage can occur on large orders or during periods of market volatility, though the STP model routes orders directly to liquidity providers to minimize this impact.

The platform offers volume-based discounts that can reduce fees to as low as 0.01% for high-volume traders. For cryptocurrency withdrawals, blockchain network fees apply and vary based on network congestion.

Security & Regulation

The platform implements multi-layered security protocols and international licensing to protect your assets against digital threats.

Storage & custody

The exchange stores the majority of user assets in cold storage wallets protected by multi-signature authorization, keeping them offline and away from potential online attacks.

Only a smaller portion of funds remains in hot wallets to support withdrawal operations and maintain liquidity. The platform uses hardware security modules (HSMs) rated FIPS PUB 140-2 Level 3 or higher to safeguard cryptographic keys and prevent unauthorized access.

Client funds are held in segregated accounts, completely separate from the company’s operational accounts. Withdrawals require manual approval and can only be processed once daily. PrimeXBT does not offer proof of reserves or transparent auditing of customer deposits, which is a concern compared to safe crypto exchanges like Kraken that regularly publish third-party reserve audits.

Account security

User accounts are protected through multiple security layers. Two-factor authentication using Google Authenticator is mandatory for all accounts. You can also enable withdrawal address whitelisting to restrict withdrawals to pre-approved addresses only.

The platform uses SSL encryption to protect data transmission and cryptographic password hashing to secure your credentials. Cloudflare DDoS protection prevents downtime from attacks. The platform continuously monitors for suspicious activity and unauthorized access attempts.

Audits & compliance

PrimeXBT maintains AML/KYC compliance using Crystal blockchain analytics tools to assess risk scores on deposited assets. The platform follows FATF (Financial Action Task Force) guidelines for Virtual Asset Service Providers and conducts ongoing transaction monitoring.

They block transactions involving privacy coins that obfuscate blockchain data and quarantine cryptocurrencies tied to illicit activities.

Regulatory licenses

The exchange holds several regulatory licenses across multiple jurisdictions, though not the Tier-1 oversight of top exchanges like Coinbase. The platform is licensed by the Financial Sector Conduct Authority (FSCA) in South Africa under FSP 45697. It’s also registered with the Financial Services Authority (FSA) in Seychelles under SD162 and licensed by the Financial Services Commission (FSC) in Mauritius.

In El Salvador, the exchange holds a Digital Asset Services Provider (DASP) license from CNAD (PSAD-0045) and a Bitcoin Services Provider (BSP) license from BCR.

The platform is registered as a Virtual Assets Services Provider (VASP) with the FCIS in Lithuania. These licenses provide regulatory oversight but are considered lower-tier compared to US SEC regulation or European MiCA licensing.

Past incidents & mitigation

PrimeXBT has operated since 2018 without any major security incidents, data breaches, or hacks affecting user funds. The platform maintains a 99.9% uptime record and has strengthened its security infrastructure over time.

Features & Tools

The platform integrates professional-grade trading platforms and advanced order types to help you execute complex trading strategies across multiple global markets.

Trading features

They offer three integrated trading platforms: PXTrader (proprietary WebTrader), MetaTrader 5, and a dedicated crypto futures platform. The platform specializes in derivatives and CFD trading rather than traditional spot exchanges, enabling you to trade with leverage across multiple asset classes.

PXTrader supports multiple order types, including market orders, limit orders, stop orders, OCO (one-cancels-other), take profit, and stop loss orders. The Crypto Futures platform supports over 140 trading pairs with adjustable leverage up to 500x, offering both cross-margin and isolated-margin modes for flexible risk management.

The platform operates on a Straight-Through Processing (STP) model, routing your orders directly to liquidity providers for deep liquidity and tight spreads. PXTrader integrates DXtrade charting on the web and TradingView on mobile, giving you access to advanced technical indicators and drawing tools.

MetaTrader 5 provides an alternative professional interface for traders who prefer that ecosystem.

You can trade forex with minimum lot sizes of 100 units, indices at 0.01 lots, stocks starting from 1 share, and commodities with varying lot sizes based on contract specifications. The platform offers negative balance protection and swap-free Islamic accounts for eligible traders.

Staking & earnings

The platform focuses primarily on active derivatives trading rather than passive income opportunities. The platform doesn’t offer traditional staking services.

The Covesting ecosystem has its own utility token called COV, which can be staked through Yield Accounts within the Covesting platform. Strategy providers on Covesting can earn up to 20% profit share from follower profits, while followers receive 70% of profits, with 10% going to the platform as commission.

Mobile app & trading access

They have mobile applications for iOS and Android devices that provide the full suite of trading tools. The mobile app includes access to margin trading, real-time charting, portfolio management, position control, deposits and withdrawals, and the Covesting copy trading module.

You can register for an account, complete authorization, and execute all trading functions directly from the app. The mobile interface is customizable and caters to both novice and experienced traders, though it simplifies some features compared to the desktop platform.

Institutional & API tools

The platform provides developer APIs and documentation for building applications and integrating with the platform. The platform also supports professional trading through MetaTrader 5 integration, which is widely used by institutional traders and advanced algorithmic trading systems.

Supported Assets & Markets

The platform provides high-leverage derivatives and major liquid assets to help you capitalize on market movements without needing deep spot order books.

Cryptocurrencies & tokens

PrimeXBT focuses on leveraged trading. You can trade major assets like Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), XRP, and other large-cap altcoins, primarily through perpetual futures and CFDs. The emphasis is on highly liquid majors and widely traded altcoins rather than thousands of small-cap tokens.

Fiat pairs

The exchange is not a classic fiat spot exchange with deep fiat order books, but it does support funding and trading in multiple fiat-linked currencies. You can deposit via bank cards, bank transfer, or payment processors, with balances typically denominated in USD or stablecoins.

From there, you trade crypto, forex, indices, and commodities as derivatives rather than holding spot fiat–crypto pairs directly. Effectively, fiat acts as your account funding currency, while most trading occurs through margin products and CFDs.

Derivatives market availability

Derivatives are the core of their offering. You can trade perpetual crypto futures with high leverage, as well as margin products and CFDs on forex, stock indices, commodities, and major cryptocurrencies.

Positions are generally non-expiring (perpetual), with funding payments used to keep contract prices in line with spot markets.

The platform does not target traditional expiring futures or options markets; instead, it focuses on perpetual contracts and margin trading with flexible leverage and cross- or isolated-margin modes.

Geographic availability

They operate in over 150 countries worldwide with multi-language support. The platform explicitly restricts access from the United States, Canada, and Japan due to their strict cryptocurrency and derivatives regulations.

Usability & User Experience

The platform delivers a specialized trading interface and comprehensive mobile tools to help you execute fast-paced trades across multiple devices.

Desktop & web interface

PrimeXBT’s web platform is built for active traders, with a layout that focuses on charts, order tickets, and position management. The main dashboard lets you see your open positions, margin usage, and available balance at a glance. The charting window gives you access to multiple timeframes, indicators, and drawing tools.

You can switch between asset classes from a sidebar and quickly toggle between different markets without reloading the page. The interface supports light and dark themes and is fully browser-based, so you don’t need to download desktop software.

Once you get used to the layout, it feels efficient and geared toward fast execution rather than beginner-friendly hand-holding.

Mobile app experience

PrimeXBT has an app for iOS and Android with most of the core functionality of the web platform. You can open and close positions, adjust leverage, monitor funding, and track markets in real time from your phone. T

he app includes integrated charts, basic order types, and account management tools, so you can manage trades when you’re away from your desk. Some of the more advanced layout customization you get on desktop is simplified on mobile, but the app is still fully capable for day-to-day trading and position monitoring.

Learning curve

If you’re new to leveraged trading or derivatives, the platform has a noticeable learning curve. You need to understand concepts like margin, liquidation prices, funding rates, and how cross vs. isolated margin affects your risk before you trade comfortably. The interface assumes you already know how order types work and doesn’t walk you through the basics the way beginner-focused spot exchanges do.

Customer support

PrimeXBT offers support mainly through a help center and in-platform contact options rather than phone-based service. The help center includes guides on account setup, deposits and withdrawals, margin mechanics, and platform features, along with troubleshooting for common issues like failed withdrawals or rejected orders.

There is live chat or ticket-style support available from within the platform, but response quality and speed can vary depending on demand. Educational content is more focused on platform use and basic trading concepts than deep strategy education, so if you want to trade complex derivatives responsibly, you’ll still need to supplement with outside learning resources.

How to Get Started

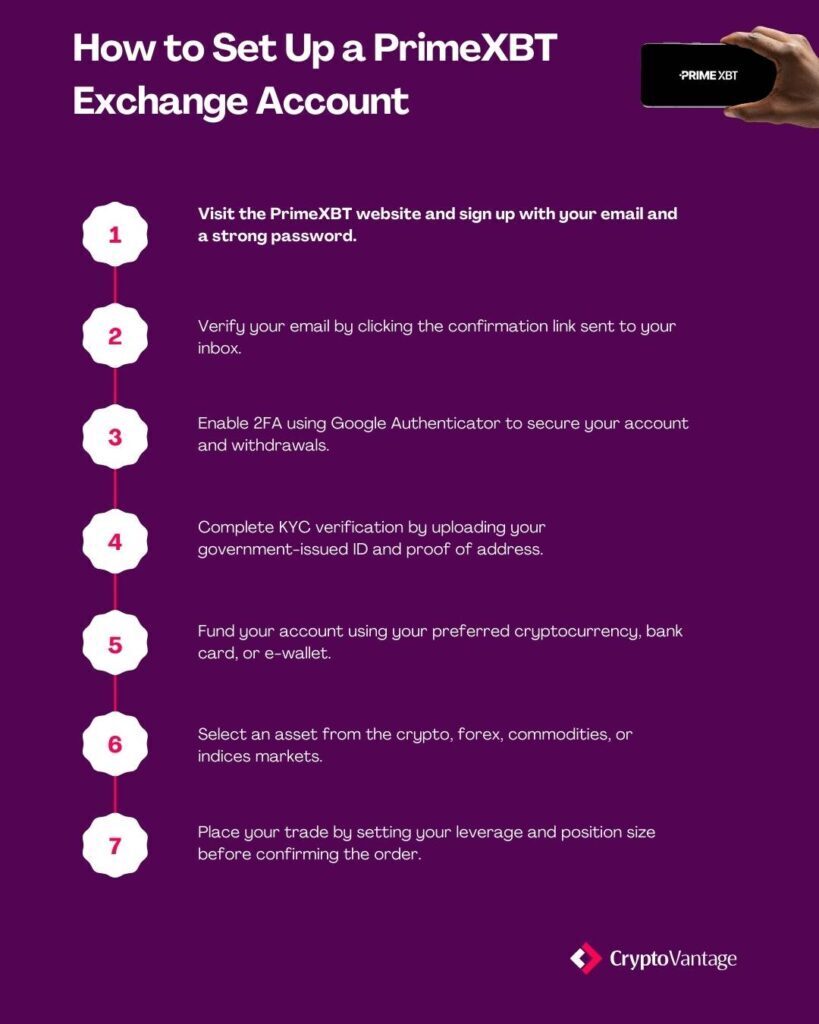

If you want to try out the platform for yourself, here’s what you need to do:

History & Background

PrimeXBT launched in 2018 as a multi-asset trading platform focused on bringing professional derivatives trading tools to the cryptocurrency market.

The platform was designed from the start to specialize in leveraged trading across crypto, forex, commodities, and indices. The founding team has maintained a relatively low public profile, focusing on building the platform’s trading infrastructure rather than high-profile marketing.

Milestones & growth

Since its 2018 launch, PrimeXBT has grown to serve over 1 million users across 150+ countries. The platform has consistently expanded its asset offerings, adding support for more cryptocurrencies, forex pairs, and CFD products over time.

In 2020, the exchange introduced the Covesting copy trading module, which became one of the platform’s signature features and received licensing from the Gibraltar Financial Services Commission.

The platform partnered with Bitfury’s Crystal blockchain analytics to strengthen AML compliance and security monitoring. The platform processes daily trading volumes ranging from $3 to $8 billion.

Reputation & public events

PrimeXBT has built a reputation as a derivatives-focused platform for experienced traders who understand leverage and margin trading. The platform has operated without major security breaches or hacks since its 2018 launch, maintaining a clean security record.

The exchange is a member of The Financial Commission, an independent dispute resolution organization that provides traders with access to a compensation fund of up to $20,000 per claim.

PrimeXBT Alternatives

PrimeXBT is a strong choice if you want a derivatives-focused platform with high leverage, multi-asset trading, and professional tools like copy trading. However, the best cryptocurrency exchanges have different feature sets that might better match your requirements.

Exchange

Ideal For

Fees & Pricing

Security Features

Regulation & Compliance

PrimeXBT

Experienced derivatives traders

Maker/Taker fees

2FA, withdrawal whitelist

Licensed in 150 countries

High-volume traders

Maker/Taker fees

SAFU fund, cold storage

Multiple regulatory licenses

Derivatives-focused traders

Volume-based discounts

Withdrawal whitelist, insurance

Licensed in multiple jurisdictions

U.S. traders prioritizing regulation

Maker/Taker fees

Proof-of-reserves, 95% cold storage

U.S. regulated,

Final Thoughts & Verdict

PrimeXBT provides a high-performance environment for seasoned traders to leverage diverse global markets, but its regulatory profile and high-risk instruments require a disciplined approach to capital management. Weaknesses involve operating without Tier-1 regulation, no proof of reserves, potential fiat withdrawal delays, a complex interface for beginners, and significant liquidation risk from high leverage.

For experienced traders who prioritize leverage, multi-asset derivatives, and professional tools over regulatory transparency, it’s a great solution. Beginners and risk-averse traders should choose heavily regulated spot exchanges instead.

FAQs

0.05% for crypto futures trading and 0.01%-0.05% for CFD trading, with funding rates of 0.05%-0.0833% on perpetuals. Leverage reaches up to 100x on crypto futures and up to 1000x on select forex and commodity pairs. Volume-based discounts reduce fees for active traders.

You can trade 50+ cryptocurrencies via futures and CFDs, hundreds of forex pairs, commodities like gold and oil, major stock indices, and individual stock CFDs. The platform specializes in derivatives.

You can deposit fiat via credit/debit cards, bank transfers, or e-wallets like Skrill and Neteller. Some users report delays with fiat withdrawals, so plan accordingly. Withdrawals require manual approval and are processed once daily.

KYC is mandatory for full platform access and higher withdrawal limits. You’ll need to submit a government-issued ID, proof of address, and complete facial verification. Basic trading with crypto deposits may have lighter requirements.

The platform offers Covesting copy trading that automatically replicates successful traders’ strategies, TradingView integration with advanced charting tools, and MetaTrader 5 support. You get customizable technical indicators, multiple order types, adjustable leverage up to 100x-1000x, and cross-margin or isolated-margin modes for flexible risk management.