Why Smart Investors Keep Choosing These Crypto Exchanges

This guide takes you on a quick journey through the transformation of crypto over the years. We’ll unpack how it started, the key milestones that shaped the market, and the defining developments of the year. This includes the best crypto exchanges that are currently leading the industry, regulatory shifts, major wins, and lessons learned.

While there are countless crypto exchanges worth recognizing, three platforms stood out above the rest. Read on to see the top performers and why they have earned their place.

Kraken: Proof-of-Reserves pioneer & trust leader

Kraken continues to lead the industry in transparency and investor protection. The exchange strengthened its proof-of-reserves (PoR) program this year, expanding audit scope and publishing more frequent cryptographic verifications to reassure users that customer assets remain fully backed.

Kraken’s PoR program has been industry-leading since 2014—and in this year, it doubled down by enhancing public reporting and security disclosures. Alongside its transparency upgrades, Kraken invested in user security tools, compliance resources, and advanced trading infrastructure, reinforcing its position as one of the safest and most trusted global exchanges for both beginners and institutional investors.

💡 Key Takeaway: Kraken didn’t just maintain its transparency leadership—it raised the bar and challenged the industry to follow.

One of the world’s most trusted and secure crypto exchanges with low fees and advanced trading tools.

Binance: Strategic comeback and smart innovative moves

2025 has been a pivotal year for Binance’s international operations. Under CEO Richard Teng, the exchange has prioritized rebuilding and reinforcing trust through stronger global compliance practices, expanded regulatory engagement, and enhanced security and risk controls.

Focusing on strengthening regulatory systems has not slowed them down, as they continue to innovate. They have rolled out new fiat access points in key regions and upgraded AI-powered fraud detection tools. Additionally, they have introduced new initiatives to support Web3 infrastructure and developer tools. With trading volume once again leading the crypto world, Binance has shown that prioritizing compliance does not come at the expense of growth—it adds to it.

💡 Key Takeaway: Binance’s renewed compliance focus, paired with ongoing innovation, has strengthened its standing as the world’s leading crypto exchange.

This section refers to Binance’s international platform. U.S. users should refer to Binance.US, a separate entity with different availability and features.

Coinbase: Compliance strength & institutional market growth

Coinbase entered the year in a uniquely strong position as global regulation tightened. With the U.S. GENIUS Act formalizing stablecoin rules in mid-2025, Coinbase stood out as one of the few exchanges already built for this regulatory era—thanks to its long-standing compliance infrastructure, public transparency, and regulated stablecoin partnerships.

The platform continued expanding its institutional services, custody offerings, and international footprint while maintaining its reputation as the most beginner-friendly exchange in North America. Their success this year comes from preparation: instead of scrambling to adjust to new policy frameworks, they were ahead of the game.

💡 Key Takeaway: Coinbase’s regulation-first approach paid off, positioning it as the most policy-ready exchange in the U.S. and a global benchmark for compliant crypto services.

A regulated U.S. exchange tailored for simplicity, security, and fiat integration.

How The Best Crypto Exchanges Compare Side-by-Side

Here’s a quick rundown of our top three exchanges. Take a look at the best features and latest updates for all, and see which exchange is best suited for your needs.

Exchange

Ideal For

Standout Update

Security

Trade

Binance

Users seeking lower fees

AI fraud prevention tools

SAFU user-protection reserves

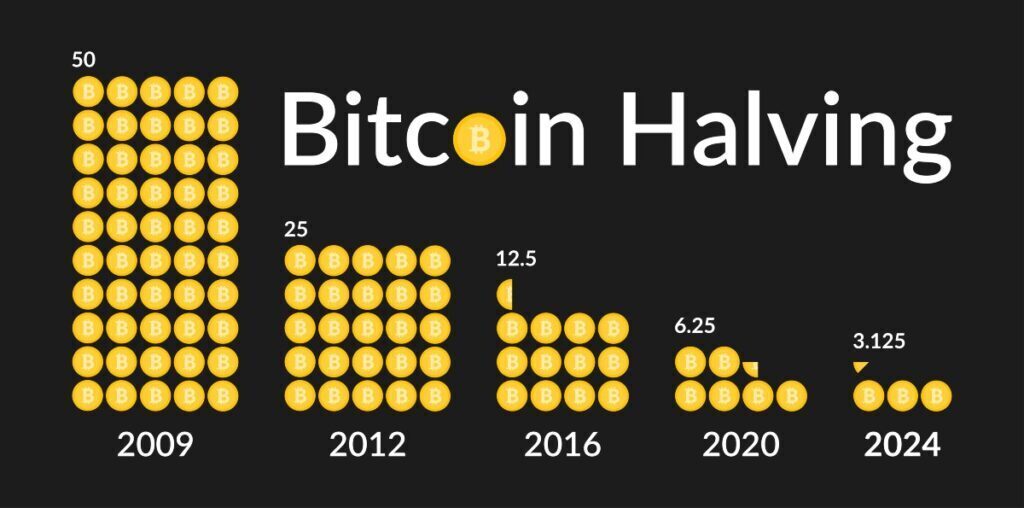

The 2024 Bitcoin Halving & Its Real Impact on the Market

Now that we’ve covered individual exchanges, let’s look at how the overall crypto trading industry performed this year.

Historically, Bitcoin’s value has increased quite significantly after each halving before crashing dramatically before recovering again. However, 2024 was different. Bitcoin hit an unprecedented high before the halving, which broke the usual pattern. Explanations might include:

- U.S. regulators approved Bitcoin ETFs in 2024, attracting large institutional investors

- Fewer crypto crashes and financial disasters stabilized the market

- Improved financial regulations drove accessibility and support

- Large-scale investors held Bitcoin for longer periods

The dramatic 80% crashes of the past may be over, as price growth has been less volatile. While this stability benefited those seeking a widely adopted financial asset, investors chasing high-risk, high-reward opportunities may have been left disappointed.

Post-Halving Market: What Happened and Why It Matters Now

The 2024 Bitcoin halving set the tone for the year’s market behavior. Reduced block rewards tightened supply, and as new issuance slowed, investor confidence strengthened. Prices responded with steady upward momentum rather than the wild volatility seen in previous cycles.

Other major proof-of-work coins followed similar trends, with moderate appreciation and greater market stability. Instead of sharp post-halving spikes driven by speculation alone, 2025 showed sustained growth driven by institutional demand and ETF inflows.

The Role of Institutional Investors and ETFs

Crypto exchange-traded funds (ETFs) let people invest without having to buy crypto themselves. Instead, they buy shares from the actual cryptocurrency owners. ETFs are bought and sold through a traditional brokerage account, making it easier for investors to have a stake without having to directly trade within the cryptocurrency market.

As a result, institutional investors now feel more confident entering the crypto market. This shift has enhanced stability, strengthened crypto’s credibility, and accelerated the adoption of regulatory frameworks.

How AI and Web3 Are About to Change the Crypto Game

Web3 and AI are two transformative technologies reshaping and decentralizing our online environments and ultimately impacting crypto as well. These have helped to:

- Evolve the Ethereum ecosystem

- Improve decentralized applications

- Bolster security and efficiency for blockchain transactions

- Automate tasks such as balancing portfolios

- Provide advanced analytics for transactions

- Enhance transparency overall

2025 Updates: New Crypto Policies That Could Make or Break You

Crypto regulation finally moved from debate to enforcement this year, reshaping how exchanges operate and how investors participate in the digital asset economy.

Rather than slowing the industry down, regulatory clarity has created a more stable and trustworthy environment—especially for serious investors and institutions entering the market post-ETF boom.

Why these U.S. and EU crackdowns succeeded

There have been multiple regulatory changes recently, mostly led by financial authorities in the U.S. and the EU. While introducing complexity, these regulations have also brought stability to crypto markets. Here are some regulations that should be on your radar:

For the US market:

- Strengthening American Leadership in Digital Financial Technology Executive Order: This order establishes a federal framework supporting digital assets and blockchain innovation.

- The GENIUS Act: Addresses the regulation and stability of stablecoins.

- Digital Asset Market CLARITY Act and similar bills: Aims to define which financial regulators oversee crypto assets and related markets.

- Executive Order 14178: Outlines the U.S. government’s position on central bank digital currencies (CBDCs) and comparable digital assets.

For the EU market:

- Markets in Crypto-Assets Regulation (MiCA): Provides EU-wide rules governing crypto-assets. Although adopted in 2023, it took effect in December 2024, effectively shaping the 2025 market.

- EIOPA’s capital proposal: The European Insurance and Occupational Pensions Authority proposed one-to-one capital requirements for EU insurers holding crypto-assets.

The global push for safer crypto exchanges

In 2025, trading crypto remained a global endeavor shaped by increasingly complex regulatory frameworks. The difference between wins and losses often depended on how effectively platforms positioned themselves as safe crypto trading exchanges. Those that strengthened compliance and transparency earned user trust, while others stumbled under tighter oversight.

The rise of trust and security tools

Because trading crypto is inherently risky, it’s no surprise that security and trust tools have been increasingly looked at to improve protections. Some examples include:

- Secure crypto wallets

- Multi-factor authentication

- Crypto payment gateway services

- Secure storage tools

- Crypto insurance

Want to learn more? See our coverage of the best crypto tools.

How to Turn Your Crypto Failures Into Winning Strategies

We’ve highlighted the positive updates from this year; now let’s discuss some things that… well, could have gone better. Failures are never fun, but they offer valuable lessons for the future. By analyzing what went wrong, investors can identify patterns, improve decision-making, and set themselves up for stronger performance in the years ahead.

Why failed projects teach us valuable lessons

An alarming number of crypto projects fail, with thousands of cryptocurrencies dropping off the face of the earth every year.

One memorable example of a failed project is the “Hawk Tuah Girl,” who was briefly a viral internet sensation. She launched the $HAWK memecoin, which initially showed potential but took a nosedive within a matter of hours. Most investors lost everything.

What these failed projects teach us:

- Be wary of flash-in-the-pan memecoins

- Don’t buy based on hype

- Prioritize risk management

- Do your own research before investing

- Don’t overinvest

AI scams and the new age of deception

The evolution of AI has put wind in the sails of crypto scams and frauds. You should always be on the lookout for Ponzi and pyramid schemes, too-good-to-be-true claims made on social media, deepfake scams, and over-promising AI-powered trading platforms.

To keep abreast with the latest news, check out California’s Department of Financial Protection and Innovation’s Crypto Scam Tracker or other reputable sources to look for known scams.

Investor fatigue and the importance of security

Investor fatigue is burnout from an unpredictable crypto market and years of ups and downs. Fatigue can cause demand for crypto to decrease and reduced market activity, which has sometimes been the case for short periods in a given year.

One way to combat this is by prioritizing security when trading. This reduces the risk of scams, unsafe exchanges, and other factors that make traders hesitant to participate.

List of fake crypto exchanges to avoid

Online security should always be on your mind, along with crypto scams and fake companies. Always do your research before investing. Here are just a few known fake exchanges to watch out for:

- BIPPAX

- I Texus Trade

- Lidcoin Trading Center

- X Coin Trading

- Bityard

- Ethereum X Corp

- Whitcoin Pro Exchange

- Dartya

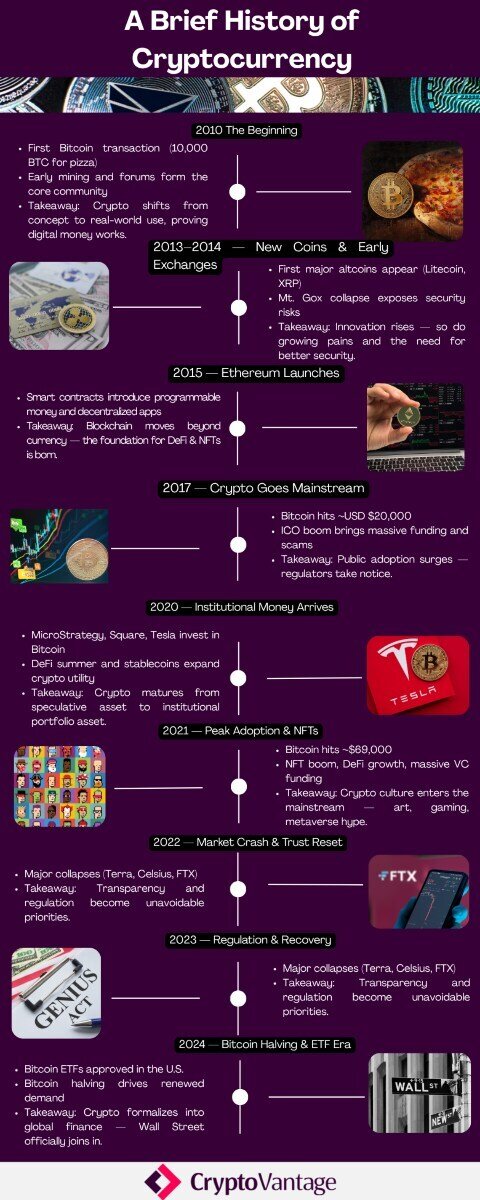

What Started Crypto? A Timeline of the Rise of Digital Currency

To understand where we are, we need to know how we got here.

Cryptocurrency began as a niche experiment in digital money—born from internet cypherpunk culture, distrust in traditional banking systems, and a desire for decentralized financial freedom.

Bitcoin’s launch in 2009 introduced the idea that money could exist without banks, borders, or government control. In the years that followed, developers expanded the concept beyond payments, unlocking programmable money, decentralized applications, digital identity, and tokenized assets.

What started as a fringe technology mined on home computers has grown into a global asset class with institutional adoption, government-issued regulations, publicly traded ETFs, and real-world blockchain utilities.

Crypto’s early days were volatile and experimental, but they established the foundation for today’s thriving and increasingly regulated digital economy.

Timeline of significant events: 2010–2024 in key milestones

Top 10 Cryptocurrencies to Invest In

The crypto market is constantly evolving, and picking the right coins can be challenging. This table highlights ten of the most promising cryptocurrencies presently—considering market performance, adoption trends, and potential for long-term growth.

Use this table as a starting point for your research before making any investment decisions.

Cryptocurrency

Category

Why It’s Still Relevant

Layer-1 Smart Contracts

Core network for DeFi, NFTs, scaling solutions & staking economy

Final Thoughts — Crypto Today & What Comes Next

There were a lot of ups and downs in the crypto environment in 2025. ETFs and regulatory changes encouraged many newcomers to enter the market, which is promising, but issues like investor fatigue and scams have tempered this enthusiasm. There are still opportunities for investors, but they should be paired with caution and education. The more you learn about the uncertain world of crypto, the better prepared you’ll be.

We always recommend doing your research and only choosing trusted exchanges with safeguards in place. By staying informed and keeping your guard up, you’ll be better able to take advantage of the crypto investment opportunities that 2026 will offer.