- >Best Crypto Exchanges

- >Coinbase Review

Coinbase Review 2026: Pros, Cons, and Tips

Coinbase at a Glance

A regulated U.S. exchange tailored for simplicity, security, and fiat integration.

Pros

New users can earn free crypto through the Earn program

User friendly design with simple buy/sell buttons with clearly indicated prices

Diverse and consistently updated choice of coins

A strong line-up of products including an exchange, wallet and staking services

Cons

Fees are right in the middle of industry standards

Some complaints about customer service

Significant identity verification required

Supported cryptocurrencies

250+ assets supported

Fiat currencies accepted

USD, EUR, GBP, CAD, AUD, and SGD

Trading volume and liquidity

$393 billion

Number of Users

100 million verified users

Customer Support

Accessible customer support, OTC services for advanced users

Fees

Transaction fee + spread

Highlights

The platform is widely regarded as the most regulated and secure “on-ramp” for crypto globally. This reputation was earned through strict compliance with several regulatory authorities like FinCEN, the Financial Conduct Authority, the Central Bank of Ireland, BaFin, and many more.

Safety is a top priority for the exchange, which uses auto-enrolled two-factor authentication, holds 99% of customer funds in cold storage, and provides advanced encryption. This is an addition to providing human support and an extensive help center for quick solutions.

Their biggest strength is their versatility. It’s a one-stop shop where you can access everything from basic wallets and staking to advanced exchange features and their international futures platform, all within a single, publicly accountable ecosystem.

Fees & Costs

The base platform uses a spread fee structure for all of their operations. Fees shift depending on whether the user is buying, selling, or trading.

Different levels of fees are in place based on the volume of the trade. It’s important to keep in mind that Coinbase charges a flat fee for transactions below $200 and a percentage-based fee for anything over that amount.

Coinbase Advanced Trade offers a more traditional fee structure, with maker and taker fees for trades. The fees are much lower using this method.

Spot Trading Fees

Instant Buy/Sell Fees

Instant crypto purchases or sales with fiat incur a spread fee plus transaction charges depending on the method and region. A spread fee is the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept. Essentially, you’ll pay a little more when making a purchase and earn a little less when selling crypto.

Hidden Costs & Spreads

Flat fees may be applied for small-volume traders, while currency conversion spreads can kick in between fiat and crypto transactions.

Security & Regulation

More than one hundred million people put their trust, and money, in the hands of Coinbase. Here are some of the things that have made the exchange trustworthy.

Storage & Custody

Approximately 99% of assets are maintained offline or in cold storage. This makes the funds less likely to be stolen. A portion of client funds is insured against hacking, and AES-256 encryption secures sensitive user data.

Account Security

Client accounts are protected through several robust security measures. These include auto-enrolled 2FA, optional withdrawal whitelists, device verification, and clear privacy controls for data management.

Audits & Compliance

Coinbase is a publicly traded company in the United States, meaning it is subject to SEC guidelines and regular third-party audits. The platform adheres to the high security standards of a SOC 2 Type II independent audit, which verifies how an organization securely manages customer data.

Regulatory Licenses

The exchange is registered with FinCEN (U.S.), FCA (U.K.), BaFin (Germany), and the Central Bank of Ireland.

Past Incidents & Mitigation

No major breaches were recorded by the exchange, and they maintain a strong track record of asset protection.

Features & Tools

The reason millions of people flock to Coinbase is the platform’s wide range of special products, tools, and features. They have an expansive range of tools and special offerings beyond simple crypto buying and selling.

Trading Features

The Coinbase Advanced Trade interface gives experienced users access to detailed charting tools, advanced order types, and more sophisticated market insights.

Professional and institutional traders can access regulated derivatives markets, including commodity futures such as oil and gold. In addition, the platform supports multiple fiat currencies, allowing users to easily move between traditional and digital assets.

Staking & Earnings

Users can stake supported assets like Ethereum, Solana, and Cosmos on the platform and earn returns that can reach up to around 15% APY.

The Coinbase Earn program provides a learning aspect to earning. Users complete short educational lessons about different crypto projects and receive small crypto rewards. This helps them grow both their knowledge and their portfolio.

NFT Marketplace & Crypto Services

Coinbase operates a dedicated NFT marketplace, offering a Web3-enabled space for exploring, buying, and selling digital collectibles.

- Coinbase Card—A Visa debit card for U.S. residents that lets users spend crypto like cash.

- Coinbase One—A premium subscription that removes trading fees, provides up to $1 million in account protection, offers 24/7 priority support, and unlocks exclusive partner perks.

These tools make it easier for users to integrate crypto into everyday spending.

Coinbase Advanced Trade & Mobile App

The standard Coinbase interface is great for newcomers who prefer simplicity and ease of use.

In contrast, the Advanced Trade interface caters to professionals who need precision, deeper analytics, and more sophisticated control over their trades.

It includes advanced order types, like limit orders and market orders, as well as real-time trading charts, exclusive order books, and more. It also has a straightforward maker-taker fee model, which I much prefer to the base site’s fee structure.

Our Coinbase review found that the mobile app is available on Android and iOS devices. The app mirrors the desktop version’s layout and functionality.

Users can view real-time charts, set custom alerts, and automate certain actions while on the move. The app also connects seamlessly with the Coinbase Wallet, enabling quick transfers between trading accounts and personal wallets.

Institutional & API Tools

Institutional and high-volume traders can use OTC (over-the-counter) services and access to regulated futures markets for larger or more discreet transactions.

Developers and professionals can use the platform’s API tools to automate trading, integrate account management, and build custom applications.

Supported Assets & Markets

The exchange supports a broad range of cryptocurrencies and fiat markets, offering users multiple ways to trade both well-known coins and emerging projects.

Cryptocurrencies & Tokens

Coinbase enables the purchase of many cryptocurrencies, including all the majors such as Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Litecoin (LTC). You’ll also find a mix of emerging and DeFi assets like Stellar (XLM), DAI, BAT, and ApeCoin (APE).

Fiat Pairs

The platform supports several major fiat currencies and accepts multiple payment methods. These include US dollars (USD), euros (EUR), and British pounds (GBP).

This means you can directly purchase assets like Bitcoin, Ethereum, and Solana using fiat—or cash out your crypto holdings back to your preferred currency.

Geographic Availability

The platform is available in more than 100 countries worldwide. However, services may vary due to local regulations.

Usability & User Experience

Our Coinbase exchange review found that the platform balances simplicity for beginners with depth for experienced traders, offering a layout that feels structured, logical, and free from unnecessary clutter.

Desktop & Web Interface

The desktop and web interface is designed with clarity in mind. The dashboard is clean and easy to navigate, making it easy for users to view their portfolio, recent transactions, and market movements. New users will find the platform intuitive, and executing core features like buying, selling, and trading crypto is easy.

Experienced traders using Advanced Trade will appreciate the decluttered interface that neatly features interactive charts, order books, and real-time data.

Mobile App Experience

Performance on the mobile application is generally smooth. Its integration with the exchange’s wallet makes it perfect for managing your digital assets and seamlessly transferring funds between accounts. The application is updated regularly to improve security and speed.

Learning Curve

The platform is renowned for its user-friendliness. Its uncluttered interface is easy to navigate and guides users every step of the way. In addition, newcomers can benefit from the Coinbase Learn program, which rewards users for learning about the blockchain.

Customer support

Customer support is available via phone, email, live chat, and even snail mail. Reaching a real human to talk to about issues can be tricky, and rather than providing an actual phone line to call in an emergency, the platform only allows you to log a request for a call or chat.

This can be frustrating at times, but the website’s support prompts can assist in solving smaller issues on-the-fly.

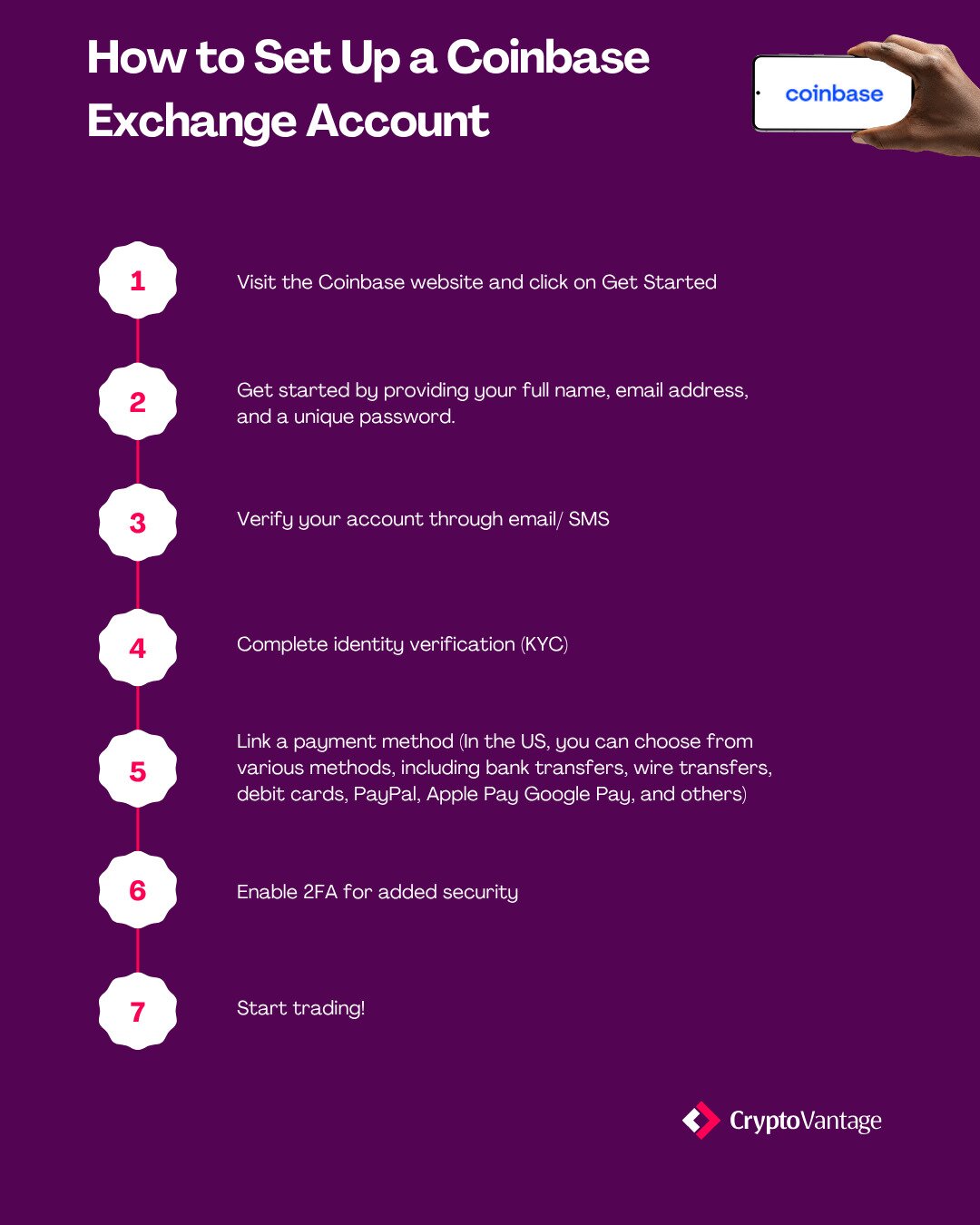

How to Set Up a Coinbase Exchange Account

If you want to try out this exchange for yourself, all you need to do is:

There’s a bit of processing time, but you should be able to purchase Bitcoin and other cryptocurrencies, as soon as you complete the aforementioned steps. Check out our How Long Does Verification Take? Guide for a more detailed rundown.

History and Background

Founding & Founder

Coinbase was founded by Brian Armstrong, a former Airbnb software engineer, along with Fred Ehrsam, a former Goldman Sachs trader. Their goal in creating the platform was to make buying, selling, and storing Bitcoin easy and secure for everyday users.

Milestones & Growth

Since 2012, the platform has grown considerably. Its pro platform was launched in 2015, providing a tailor-made exchange for high-volume and institutional traders. In 2021, they became the first US-based crypto exchange to become a publicly traded entity when they were listed on the NASDAQ.

In 2023, Coinbase Pro was retired, and advanced trade was launched to combine professional tools and lower fees within the main platform.

Reputation & Public Events

The platform has built a reputation for being reliable, transparent, and secure. Its US compliance is a major positive for its users, and its user-centric approach makes crypto accessible for everyday traders.

Their prioritization of securing customer funds through cold storage, insurance protection, and regular audits makes them trustworthy.

Coinbase Alternatives

Coinbase is a great crypto exchange, but it’s not for everyone. If you’re curious about how it stacks up against other popular exchanges, check out our informative crypto exchange comparisons.

Exchange

Ideal For

Fees & Pricing

Security Features

Regulation & Security

Coinbase

Beginners and fiat-focused traders

~0.5% spread + flat fee

Cold storage, insured assets

SEC-regulated, public company

Security-first advanced traders

0.16% / 0.26%

Proof-of-reserves, cold storage

U.S. & global licenses

Final Thoughts & Verdict

Coinbase is easily one of the top two crypto exchanges that’s top of mind whenever anyone asks me for a recommendation – especially for beginners. Are there places that might be better for more advanced players, maybe those looking for more altcoins? Yes. However, this is simply one of the safest, most trusted brands in the industry.

If you’re looking for a reliable place to invest and save your money, Coinbase it is. The platform also offers a lot more beyond that, like fair customer service, a wide variety of alts, some DeFi, some NFT and some staking features.

FAQ

You might have heard that cryptocurrency can be fairly volatile, so you never know exactly how much Bitcoin is going to cost on any given day. However, what we can tell you with certainty, is that the cost of purchasing Bitcoin will depend on various factors, such as your trading volume, the payment method you select, the order type, and more.

While most coins are technically “stored” on their blockchains, you can say that the coins you have on the exchange are “stored” on the exchange, until you transfer them to a wallet that you alone control. They own the private keys that represent true ownership. To increase security, 98% of customer funds are stored offline where they are inaccessible to remote attacks. The platform also requires two-factor authentication on all accounts, and all user information is encrypted.

Even so, we advise that you never keep more than you are willing to lose on an exchange — always transfer your coins to a secure wallet once you’ve made your purchase.

According to Coinbase’s insurance policy, they maintain commercial criminal insurance in an aggregate amount that is greater than the value of the digital currency they maintain in online storage. That means if someone hacks the exchange and steals their coins, they are insured for the loss.

The platform is 100% legal in the United States. In fact, it operates as a regulated cryptocurrency exchange – meeting strict regulations for institutions like the Financial Crimes Enforcement Network (FinCEN), the New York Department of Financial Services (NYDFS), the Securities and Exchange Commission (SEC), and the Commodity Futures Trading Commission (CFTC).

Yes, Canadians can use Coinbase. Canadians are not restricted to only using exchanges that are Canadian. Coinbase is an American exchange, and is a great option for Canadians looking to purchase Bitcoin and other cryptocurrencies.