- >Best Crypto Exchanges

- >Uphold Review

Uphold Exchange Review 2026: Best Features and Fees Revealed

Uphold at a Glance

Uphold isn’t just another crypto exchange—it offers access to a wide range of assets, from cryptocurrencies to precious metals and even carbon credits. With strong security measures and a solid reputation, it caters to both beginners and seasoned traders.

Whether you’re just starting out or looking to diversify your portfolio, the platform’s sleek, intuitive platform makes it easy to trade with confidence.

A multi-asset platform allowing easy swaps between crypto, fiat, and metals.

Pros

Trade crypto, fiat, metals, and carbon credits.

Over 300 tokens to trade.

User-friendly interface with mobile support.

Transparent pricing with no hidden fees.

Cons

Higher staking fees than some competitors

No live chat or phone support.

Debit card withdrawals aren’t supported.

Supported Cryptocurrencies

300+ digital assets

Fiat Currencies

27+ fiat currencies, including USD, EUR, GBP, and more

Trading Volume and Liquidity

$40 billion+

Number of users

12 million+ users

Customer Support

Online help center, FAQs, OTC services for institutional clients

Fees

Spread-based pricing

Highlights

Uphold is a beginner-friendly platform that has gained a reputation for simplifying trading. The platform not only offers the widest range of tokens on any centralized finance (CeFi) exchange, also allows users to trade crypto, special metals like gold and silver, and U.S. equities trading.

Its institutional-grade security mechanisms and transparency cemented its reputation as one of the safest cryptocurrency exchanges. Security features offered by the exchange include two-factor authentication (2FA), encryption, and a sleek mobile app that has the option for a biometric login. Their mobile app is easy to use and allows users to manage their investment portfolios on the go.

The exchange’s signature feature is its One-Step conversion, which allows users to directly trade between any two supported assets. This means users can convert BTC to gold or a fiat currency to XRP without needing to convert to a base currency first.

Fees & Costs

Uphold doesn’t charge monthly account fees. You only pay fees when you make transactions or withdrawals. The platform uses spread-based pricing, which fluctuates depending on the asset and market conditions. Instant withdrawals may also include a small additional fee.

Instant buy/sell fees

Unlike most cryptocurrency exchanges that charge maker-taker fees, the Uphold crypto exchange uses a spread-based pricing system. This means that the cost of executing a trade is built into the difference between the buy price and the sell price.

This means that the user won’t see a separate transaction fee, as the fee is already factored into the price of the trade. Spread fees range from 0.2% to 2.95%, depending on the asset.

Category

Rate

Major Stablecoins

< 0.25%

Major Market FX

0.3%

BTC, ETH

1.5%–1.65%

Altcoins

2.55%–3.10%

Precious Metals

2.05%–3.10%

Deposit & withdrawal fees

Deposit and withdrawal fees ultimately depend on the payment method chosen by the user.

Bank transfers like ACH in the U.S. are free, and users won’t be charged by the exchange, while card-based deposits typically carry a small fee. Crypto deposits on the platform are free.

Crypto withdrawals are subject to a network (blockchain) fee, and the exchange will add an extra fee for facilitating the transaction.

Hidden costs & spreads

The spread used by the exchange is the main cost users will incur when using the exchange. However, spread fees may vary during high market volatility. The exchange may add a minimum transaction fee for low-value trades.

Security & Regulation

The exchange’s commitment to transparency and security is a major reason why well over 12 million people trade on the exchange. Let’s delve into this.

Storage & custody

Uphold is renowned for maintaining 100% reserve. This means that customer funds are held by the platform and are not loaned out. Assets and liabilities are published on a real-time public Reserve Ledger to maintain transparency.

The platform offers custodial and self-custody options. Their centralized custodial wallet is popular among users, while the Uphold vault, an assisted self-custody signature wallet, allows users to retain control of their private keys.

Account security

Clients accounts are protected by mandatory two-factor authentication (2FA), advanced data encryption, and email verification for suspicious activity. In addition, the exchange’s mobile app supports biometric login and features a one-click account-freezing button.

Audits & compliance

The platform holds the industry-standard SOC 2 Type 2 certification, which verifies its rigorous security controls for managing customer data over time. It is also ISO 27001 certified, which validates its comprehensive Information Security Management System (ISMS).

Regulatory licenses

The exchange is a registered Money Services Business (MSB) with FinCEN in the United States. It is also an Electronic Money Distributor (EMD) Agent regulated by the FCA in the United Kingdom. They also maintain registration with FINTRAC (Canada) and in the EU (Lithuania).

Past incidents & mitigation

The exchange has a strong track record of protecting customer funds and has not reported any major security breaches resulting in customer asset loss.

A third-party communications vendor incident in 2022 resulted in a limited disclosure of user email addresses and names. Critically, no user funds or login credentials were compromised.

Features & Tools

The exchange offers simple, beginner-friendly tools all centered around its anything-to-anything conversion tool. There is a mobile app for trading on the go and advanced trading tools for institutional users.

Trading features

Uphold’s signature feature is its One-Step conversion, which allows users to directly trade between any two supported assets. This means users can convert BTC to gold or a fiat currency to XRP without needing to convert to a base currency first.

The exchange supports advanced trading tools, including limit orders, take profit orders, trailing stop orders, and recurring buys.

Staking & earnings

The platform offers competitive staking APYs on several proof-of-stake assets, with rewards being paid weekly and auto-re-staked. Users can also earn interest at competitive rates on stablecoin balances.

Crypto services

The Uphold card is a Visa/Mastercard debit card allowing users to spend supported assets, including crypto, fiat, and special metals.

A great feature of the crypto card is that it allows users to automatically convert the chosen funding source (cryptocurrency) into the local fiat currency at the point of sale. Users can earn crypto rewards when using the card and enjoy various benefits, including zero fees for foreign transactions.

Mobile application

The mobile app is highly rated for simplicity and ease of use and allows users to manage their full multi-asset portfolio and execute “anything-to-anything” trades on the go. There is no separate application for institutional or high-volume traders.

Institutional & API tools

The exchange offers dedicated over-the-counter (OTC) services to high-volume traders and institutions. The platform aims to provide users with deep crypto liquidity, research, and trading infrastructure.

To sign up for an institutional account, applicants must provide detailed documentation, including proof of identity for key people, business registration documents, source of wealth, and shareholder information.

Their API tools allow businesses and developers to connect their software directly to the exchange without needing users to log in manually and do everything themselves. This allows them to automate tasks, accept payments, and manage money automatically and at scale.

Supported Assets & Markets

This exchange offers an impressive range of assets, including well-known cryptocurrencies, altcoins, fiat currencies, precious metals, and stocks.

Cryptocurrencies & tokens

The exchange supports over 300+ digital assets, including major cryptocurrencies like Bitcoin, Ethereum, and Ripple. Emerging altcoins, stablecoins, DeFi tokens, precious metals, and U.S. equities are supported.

Fiat pairs

The platform supports 27+ major fiat currencies, including US dollars (USD), euros (EUR), British pounds (GBP), Canadian dollars (CAD), and Australian dollars (AUD).

Geographic availability

While services are concentrated on serving North American and European users, Uphold is available in more than 180 countries. Functionalities and specific servers may vary depending on local regulatory limitations.

Usability & User Experience

Our Uphold review found that the exchange made a concerted effort to provide users with a streamlined, simple interface. This makes trading easy for new and experienced traders.

Desktop & web interface

The web interface design is clean and modern. This makes it easy for users to keep track of their crypto, fiat, metals, and stocks. Their interface is intuitive and easy to navigate, and the one-step conversion tool is prominent on the page. While this makes for quick and easy trading, experienced users will note the lack of advanced charting tools, order books, and other professional features.

Mobile app experience

We found that the mobile app runs smoothly on both iOS and Android devices. Its interface is similar to the website, making it easy for users to switch between the two platforms. The app allows users to trade assets, manage their portfolios, set recurring buys, and use their exchange-linked card for purchases.

Learning curve

The learning curve for Uphold is minimal, as their entire platform is designed to make trading and investing simple. While being beginner-friendly, the help center offers detailed guides and troubleshooting resources users can consult should they face challenges.

Customer support

Customer support is accessible through the platform’s online help center. Users can also submit emails and web forms should they require assistance. Phone support is very limited, and only institutional clients receive access to dedicated OTC services and support.

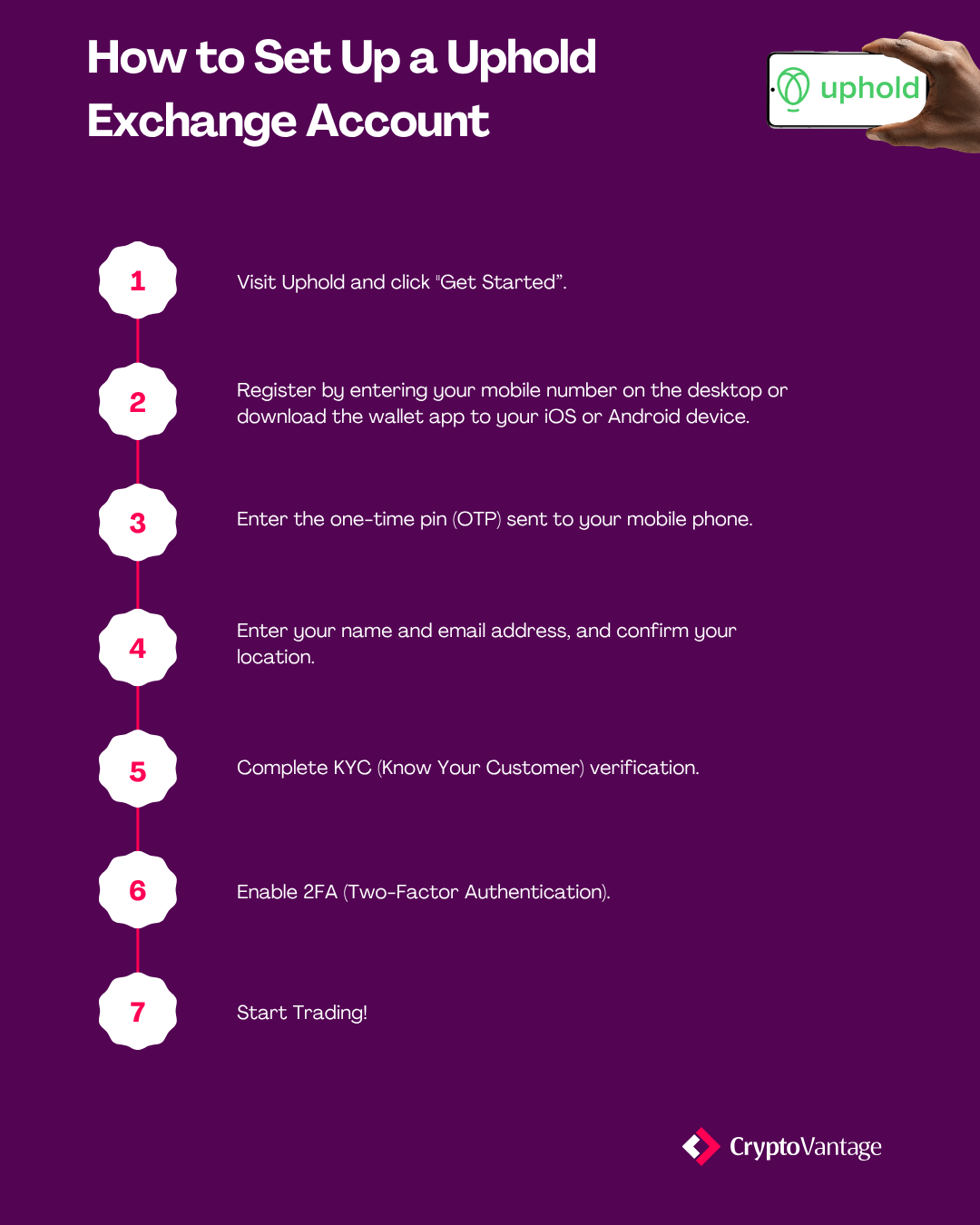

How to Set Up an Uphold Exchange Account

Here’s a quick guide to setting up a crypto exchange account on the platform.

You may have to wait while ID and income verification are completed, but you can start trading immediately. You need to be verified to withdraw funds.

History & Background

In 2014, Halsey Minor founded Bitreserve, which aimed to provide Bitcoin storage for users with an evolving API. In 2015 the platform was rebranded, and Uphold was born. Today, it’s a multi-asset digital platform, serving over 140 countries across several currencies (crypto and traditional) and offering an extensive suite of financial services to the global market.

Milestones & growth

The company has reached many milestones since their launch in the mid-2010s. This includes expanding their digital asset offerings, expanding their presence across the globe, and developing instructional-grade trading infrastructure.

Reputation & public events

The exchange maintains a reputation for transparency and regulatory compliance, supported by its real-time reserve reporting and emphasis on fully backed customer assets. They actively participate in industry discussions, publish research, and respond publicly to major market events to reinforce trust.

These factors position the exchange as a stable and safe place to trade crypto.

Uphold Alternatives

If you want ease of use, transparency, and solid security, Uphold is a top choice. If Uphold isn’t for you, consider Coinbase, Binance, or Kraken. Each has its asset range and unique features.

Exchange

Ideal For

Fees and Pricing

Security Features

Regulation and Security

Uphold

Multi-asset investors

Spread-based + instant withdrawal fee

2FA, real-time reserves

Licensed in multiple regions

First-time crypto buyers

Maker/Taker + card purchase fees

Majority cold storage

SEC Regulated

Global, high-volume traders

Maker/Taker; discounts with BNB

SAFU protection fund

Registered in several jurisdictions

Security-focused traders

Maker/Taker fees

FIDO2 hardware key support

Strong U.S. & EU oversight

Final Thoughts & Verdict

Uphold is an ideal platform for beginners and users who want a simple, multi-asset trading platform. Their intuitive web and mobile interfaces make the platform easy to navigate, and their transparency fills users with confidence in the platform.

If you value convenience, portfolio diversity, and straightforward conversions over advanced charting or high-frequency trading, it will be the ideal exchange for you.

FAQs

Yes. the exchange is regulated, transparent, and uses strong security protocols. As mentioned earlier, it’s backed by 100% reserves and complies with global financial standards.

You can trade over 300 cryptocurrencies, including Bitcoin, Ethereum, Solana, XRP, and loads of altcoins. You can also trade fiat currencies and precious metals.

They dont charge monthly fees, but expect to pay high spread fees. They’re not the lowest in the market, but you’ll know what you’re paying upfront, with no hidden costs.

For those who are new to the cryptocurrency space, the exchange compares favourably to Coinbase. The usability of the app interface is comparable to Coinbase, but Uphold generally charges lower fees. Advanced traders will still probably want to opt for another platform that can offer even lower fees.

Purchasing silver or gold on Uphold should be viewed as generally safe. The precious metals are stored in five protected and insured vaults around the world.